Eight years after confirming that it was entering the watch market, albeit via Android Wear – an extension of the Android operating system into wearable technology – rumours are rife that Google is about to launch its own smartwatch under the Pixel brand.

According to to mutiple media reports, Google is set to release a smart watch early next year. In what it claims as an “exclusive”, businessinsider.com reports,“Google is working on a smartwatch that it plans to launch next year as the search giant makes a renewed push in the wearable-tech space.

“The device, which is internally code-named ‘Rohan’, will showcase the latest version of Google’s smartwatch software to customers and partners, according to internal documents Insider viewed and multiple current and former employees.

“Those employees spoke on condition of anonymity because they were not permitted to discuss Google’s plans.”

Background reading: Apple Watch speculation; 10 years on from the first predictions

Google has been very late to the party; while it first released its Pixel smartphone in October 2016, Google has never produced its own smartwatch, despite the fact the company confirmed the first preview of a new smartwatch and its wearable technology in March 2014.

It chose high-profile fashion watch brand Fossil as well as Motorola and LG to be its first ‘partners’.

“To date, Google has opted to create software for smartwatches built by partners such as Samsung but has not made a device of its own. A Google-branded smartwatch would involve the company going toe-to-toe with Apple, whose Watch has proved a runaway success and captured control of the smartwatch market,” businessinsider.com reports.

“Unlike the Apple Watch, Google’s smartwatch is round and has no bezel, according to artistic renderings Insider viewed and employees who have seen it. Like Apple’s device, it will capture health and fitness metrics.”

Hugh Langley, the website’s Google and Alphabet correspondent, claims to have viewed documents about the proposed smartwatch, including Google staff feedback.

“Work on Rohan has accelerated this year. Google has let employees outside the smartwatch team test the device and provide feedback — a common practice known as ‘dogfooding’ — according to employees and feedback documents viewed by Insider. One of those feedback sessions took place as recently as last month, according to some of the documents,” he writes.

Langley goes on to explain that the actual brand name for the watch is unclear as it has sometimes been referred to as the ‘Pixel watch’ or ‘Android watch’, however, a number of names have been used to refer to the project.

“The existence of a smartwatch code-named Rohan was previously reported by the YouTuber Jon Prosser. Google has big plans for its wearables business. It closed a $2.1 billion acquisition of Fitbit in January, and Fitbit has said it intends to eventually build devices that run Google’s operating system.

“However, Google does not intend to brand the Rohan watch as a Fitbit device,” the article states.

Google Pixel Watch Exclusive Renders

In collaboration with @jon_prosser pic.twitter.com/JpuzFDh1KE— Ian Zelbo (@RendersbyIan) April 11, 2021

Apple’s dominance

A Google competitor to the Apple Watch has been a long time in coming, so much so that it is estimated that Apple’s market share of the smartwatch market is between 45-50 per cent.

According to Neil Mawston, executive director devices, Strategy Analytics, “Apple owns half the global smartwatch market today at 46 per cent. Samsung has 18 per cent Garmin 7 per cent while the remained 29 per cent is “other’ brands. The top-three brands make up 7 in 10 of global sales.”

Research completed by Strategy Analytics estimated that Apple shipped 10 million watch units worldwide in Q3 2021.

Sujeong Lim, analyst Counterpoint Research, another firm that specialises in the technology industry, believes the Apple Watch ‘user base’ is now more than 100 million.

“The smartwatch attach-rates for smartphones have been steadily rising. Apple’s ecosystem is seeing a greater attach rate as the brand continues to bake in attractive designs, health features, and related services around it.

“Apple Watch’s user base crossed the 100-million mark for the first time during the quarter ended June [2021], capturing the lion’s share of the smartwatch user base globally. The US continues to be the key Apple Watch market, contributing to more than half of its user base, with an attach rate of close to 30 per cent,” Lim said.

A 6 December report by International Data Corporation (IDC), another research firm specialising in the tech market gave an indication into the competitiveness of the market: “Although the pandemic has driven interest in health and fitness tracking, wrist-worn wearables such as watches and wristbands faced challenges during the quarter as these devices were not immune to the supply constraints and shifting demand brought about by the pandemic.

“While the category has recently been led by Xiaomi’s low-cost bands, the company was dethroned by Apple and Huawei in Q3 2021 as they tied for first place in the wrist-worn segment.”

It should be noted that firms such as IDC, Counterpoint Research, and Strategy Analytics do not have ‘official’ insight into Apple’s sales data, supply or retail channels; they provide estimates based on their own independent research.

In the past, Apple has questioned and cast doubt on the methodology and, more importantly, results, of many market research firms while Apple executives have sometimes dismissed the data as incorrect.

Wristbands vs Watches vs Smartwatches

|

| Samsung’s Smartwatch |

|

| Huawei’s Smartwatch |

|

| Motorola’s Smartwatch |

|

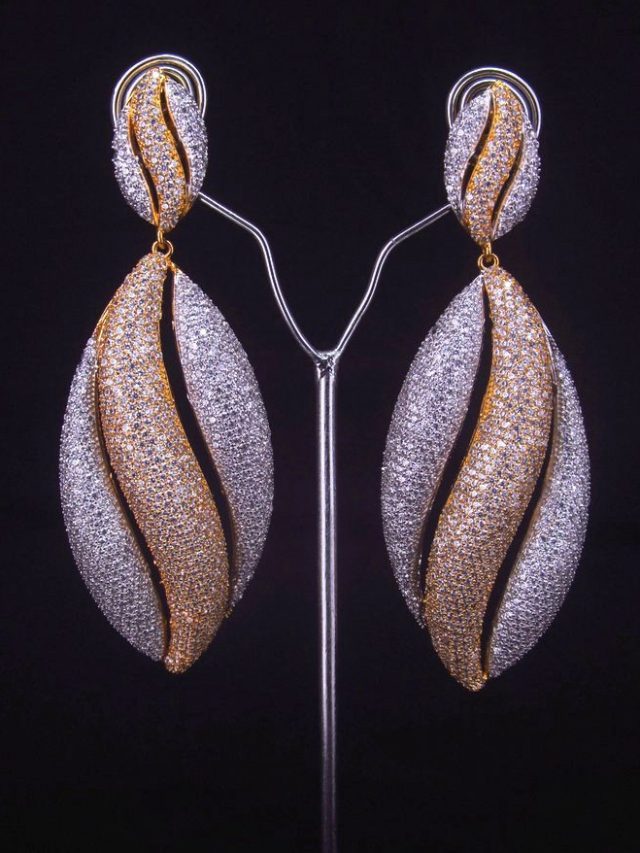

| Fossil’s Smartwatch |

According to Jitesh Ubrani, research manager IDC, “Demand has been slowly shifting away from wristbands towards watches as consumers increasingly want a more capable device and as the gap in pricing narrows.

“The number of watches sold for under $100 is now equal to wristbands, which have dominated this price band in the past. Growth amongst Indian and Chinese brands has been leading the low-end watch space while Apple, Huawei, and Samsung maintain a hold at the high-end.”

Jeweller does not consider fitness trackers, and other early digital watches as ‘smartwatches’. For the purpose of watch and jewellery industry analysis, we see three watch categories: traditional watches, digital watches and smartwatches; the latter being products that are not restricted to the brand’s own technology.

Strategy Analytics defines a smartwatch as “a computerised wristwatch with an expandable operating system, which can be loaded with third-party apps, such as Wear OS or watchOS.”

Its definition does not include “less-computerised or less-expandable devices, such as sports-watches, basic digital watches, kids-watches, fitness bands, fitness trackers, medical trackers, and so on”.

While Google will face stiff competition for its ‘Pixel Watch’ more consumers are choosing to wear technology on their wrists.

“While the entire wrist-worn wearable market declined year-over-year, the market for watches actually grew 4.3 per cent,” Ramon Llamas, research director for IDC’s wearables team, writes.

“And even as smartwatches (devices capable of running third-party applications) have been very popular, it’s the other watches – including kids’ watches, exercise watches, hybrid watches, and others – that drove the market. That’s not to say that smartwatches are losing steam; on the contrary, Apple’s late release of the Watch Series 7 and WearOS relaunching itself among its many hardware vendors will soon generate renewed interest,” Llamas added.

Lim says, “Thanks to the steady popularity of the Galaxy Watch 3 and Watch Active 2, Samsung showed a quick recovery from last year’s somewhat sluggish performance. Garmin recorded its highest shipments ever during the quarter. Among the Top 5 brands, only Huawei fell compared to the same period last year.

“The decline in its smartphone business seems to have affected its smartwatch sales, as the smartwatch from such a vertical player is tightly optimized with the brand’s smartphones and the users’ loyalty to the brand’s ecosystem of offerings.”

Long time coming

The speculation about a Google-branded watch is still just that, speculation. And the rumours have been around for many years.

Writing on techadvisor.com, Chris Martin notes: “A bit like the OnePlus Watch (which is finally a reality), it feels like we’ve been waiting forever for Google to release an own-brand smartwatch.

“It was way back in 2018 when it was confirmed that Google was definitely working on a Pixel Watch but in an interview with Tom’s Guide, Google’s director of engineering for Wear OS, Miles Barr, said it wasn’t quite ready for primetime just yet.”

The story notes that in April 2021, “Jon Prosser shared an image of the supposed Pixel Watch, showing an extreme close up of the watch face, with a physical crown in the background. This was later followed up with high res renders showing the watch from various angles. At that point, it was due to launch in October 2021 but got delayed.

“Prosser then tweeted to say it is due in Q1 of 2022, and although Insider has published an exclusive report on the Pixel Watch coming next year, it doesn’t appear to have any information that wasn’t already known via Prosser,” Martin wrote.

Background reading: Apple pick-pocket Watch – the real ‘game’

There’s no doubt that Google launching a smartwatch – no matter the name – will expand the market, and the long delay will make the battle with Apple more interesting.

“Looking at the success of Apple Watch, more OEMs have entered the smartwatch market with a relatively less advanced OS but comparable fitness and health-related features, and stylish designs at affordable prices targeting hundreds of millions of potential users globally.

The pandemic has further pushed consumers towards being more health-conscious and features such as SPO2 and heart rate monitoring have trickled down to the sub-$100 smartwatch segment. The sub-$100 smartwatch segment grew a massive 547 per cent annually, highlighting its mass-market reach,” Lim said.

Picking pockets is the real game

The issue, on the one hand will be to what degree Google can differentiate its new smartwatch from the Apple Watch to gain sales volume, but on the other hand, as Jeweller has previously reported, the long game is more about these watches picking consumer’s pockets – establishing an income stream through continued software-related purchases.

In fact, while there are many smartwatches that compete against traditional watchmakers, Apple and Google stand alone in the ultimate ‘game’ of wrist payments, not watch sales.

No, Apple and Google aren’t competing against the Swiss and Japanese to sell something that tells the time, and nor do they need revenue from selling a ‘watch’; but they do want to own your wrist to gain access to your wallet; every hour of every day, long after you made that original smartwatch purchase.

In effect, they want to ‘pick your pocket’ or, at least, your wallet, by clipping the ticket on every purchase made, and they have the technology to do it. What’s more, you will be happily assisting them by strapping the device to your wrist.